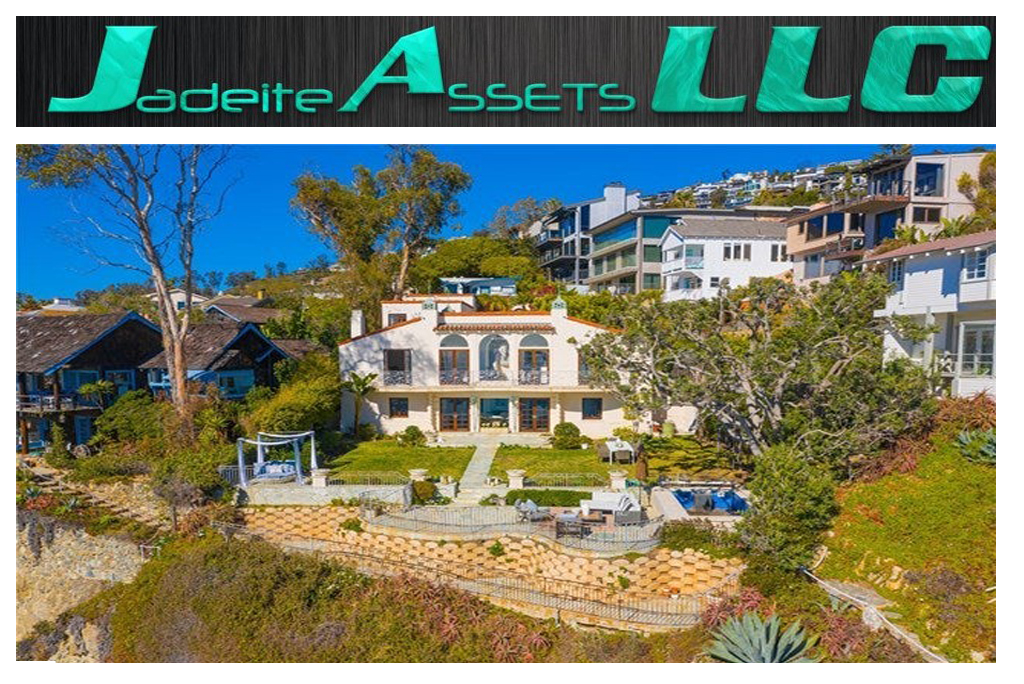

For those looking to purchase a rental property as an investment, the California real estate market has a broad variety of options. California is the most populous state in the United States, with a population of 39.3 million people. Agriculture, banking, entertainment, manufacturing, health, and technology are only a few of the industries that make up its economy. It is the birthplace of Hollywood, the world’s biggest and oldest film industry. In addition, the state is home to the world-famous Silicon Valley. California continues to draw local and international visitors all year due to its mild climate and beautiful landscapes. If you’ve been considering purchasing an investment property in California, contact Malik Mullino. He is founder of Jadeite assets LLC focuses on offering the best advice to develop wealth through real estate investment and is the preferred option of thousands of investors.

How the California Real Estate Market is Doing?

Since everybody seems interested in moving to cities such as San Francisco and Los Angeles, the mortgage rate in California was always substantially higher than other states. However, since the year 2019, things seem to have changed. According to a report, the population of the state did not increase in 2019. Around 200,000 people relocated to neighbouring states such as Colorado, Idaho, Arizona, and Utah, where housing prices are lower and where new jobs are easier to come by.

Around a million of the state’s 15 million homes will change owners each year. This is why the California real estate market is so difficult to bring down. The state’s housing market was able to end 2021 on a high note, with the median house price breaking yet another milestone.

The following year, in 2021, the state saw its largest increase in real estate sales and pricing in 17 years. According to reports, the state’s year-to-date percentage of home sales has already surpassed 16% in February.

How the Pandemic Affected California’s Real Estate Market?

Realtors in California had to cancel open houses, much as they had to in other states. As a result, according to agent data, buyer interest has decreased. C.A.R also made a flash poll, which revealed that 54% of real estate companies had purchasers who retained their retention due to the pandemic. Meanwhile, 45 percent indicated that they had sellers who had also backed out of selling their assets.

Nonetheless, technology was able to assist realtors in attracting sellers and buyers. Virtual open houses were held because real estate sales, including home purchases, were permitted to proceed throughout the pandemic.

Overall, the pandemic had a short-term effect on California housing, but it was able to quickly recover months after the outbreak. The state eventually experienced a revival of strong housing demand.

Is the California real estate market a good place to invest?

Before looking at the best places to invest in California, let’s look at why buying investment properties in the state is a good idea.

Strong job market – The headquarters are located in California, where there are many Fortune 500 companies, such as Safeway, Apple, Chevron, Intel, Google, Walt Disney, Visa, Oracle, and Yahoo. With the high rate of employment, house rents in California will still be demanded.

Low property taxes – In California, Kiplinger.com lists the top ten tax-friendly states in the United States. Although in Silicon Valley and other regions, property taxes are very high, state taxes on properties, in general, are below average. The median property tax rate is $729 for every $100,000 of home valuation. Investors can enjoy greater returns on investment by low property taxes.

High rental demand – The demand for rental property remains strong, as a large number of people flock to California for work, outdoor activities, great entertainment and favourable weather. The coronavirus pandemic has caused a recession in the local market, but now the economic trend is on the rise.

Increasing home values – The California Association of Realtors (CAR) forecasts that the median home price will rise by 1,3% in 2021 to $648,760, in a recent California Housing Market forecast. With the low inventory, the local housing sector is projected to remain a market seller by 2022.

There are four main tips you must remember while investing in the 2021 immobilisation market in California.

BE CAUTIOUS

Be careful to choose both your location and property. Get to know the neighbourhood before you choose a property. Has positive development occurred? What’s the rate of crime? See all the details around each property to get an idea of how the area will look in five years and then ask yourself if it will be worth your investment. Be conscious and follow your own direction, rather than taking the same path as anyone else.

KNOW YOUR MARKET

Get acquainted with the real estate market in which you want to invest. In smaller communities, the real estate market would be much different than in major metropolitan areas. Understanding how markets function in various fields is a good way to choose the best place to start investing. If there are revitalization efforts in place, smaller cities will show greater investment. Market research every day. Also, small market shifts would have a major effect on your investment.

HAVE A PLAN

Introduce a strong investment strategy. Ensure that contingencies that impact your investment potential in the future are included. Take time to think about your investment strategy in every phase. In particular, the larger urban areas, California is constantly evolving. Do your homework before setting your goals and follow up with extra care. Keep it in place when you have your schedule. However, you should make adjustments for the long distance to ensure that you remain consistent with your objectives.

DON’T GET IN OVER YOUR HEAD

Once you have planned, be careful of people who try to force you to spend more than you should. Any investment is in danger. Any investment. If you don’t know the profitability of an investment, mitigate your risk by starting with a small investment. If it starts to take off, you can always put more money into it. You can overly expand financially by investing too quickly. Don’t risk the penalties you might face if the investment deal is pushed out. Invest in your means and don’t let it go.

Check out images of Some Popular Property Pictures